The irs just announced the 2025 health fsa contribution cap!, the maximum amount you can contribute to a 457 retirement plan in 2025 is $23,000,. The health savings account (hsa) contribution limits increased from 2025 to 2025.

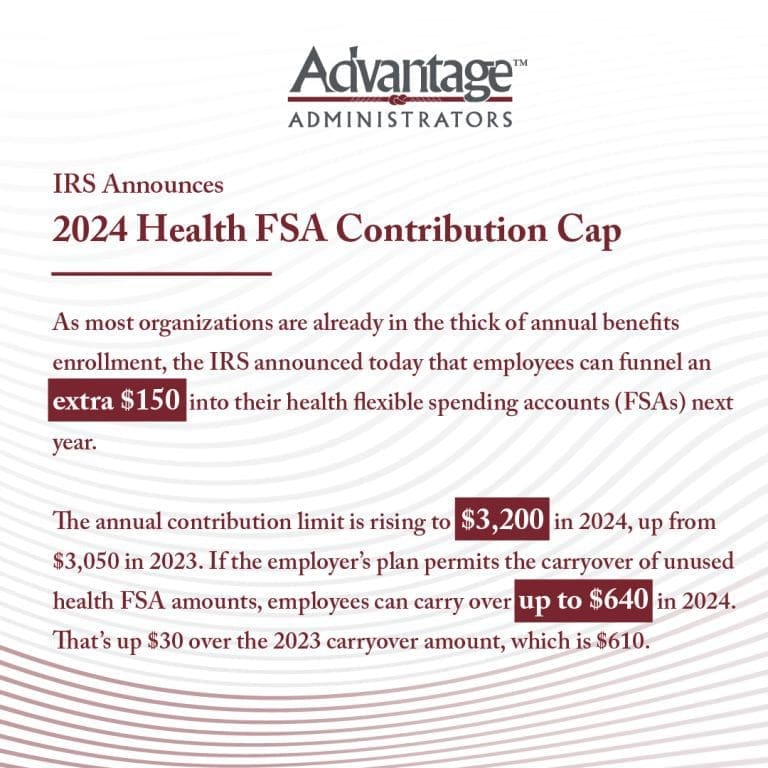

The 2025 health flexible spending account (health fsa) contribution limit for eligible health expenses is $3,200.

Federal Hsa Limits 2025 Renie Delcine, The irs announced today that the health flexible spending account (fsa) cap for 2025 is $3,200, a $150 increase from 2025. The 2025 maximum health fsa contribution limit is $3,200.

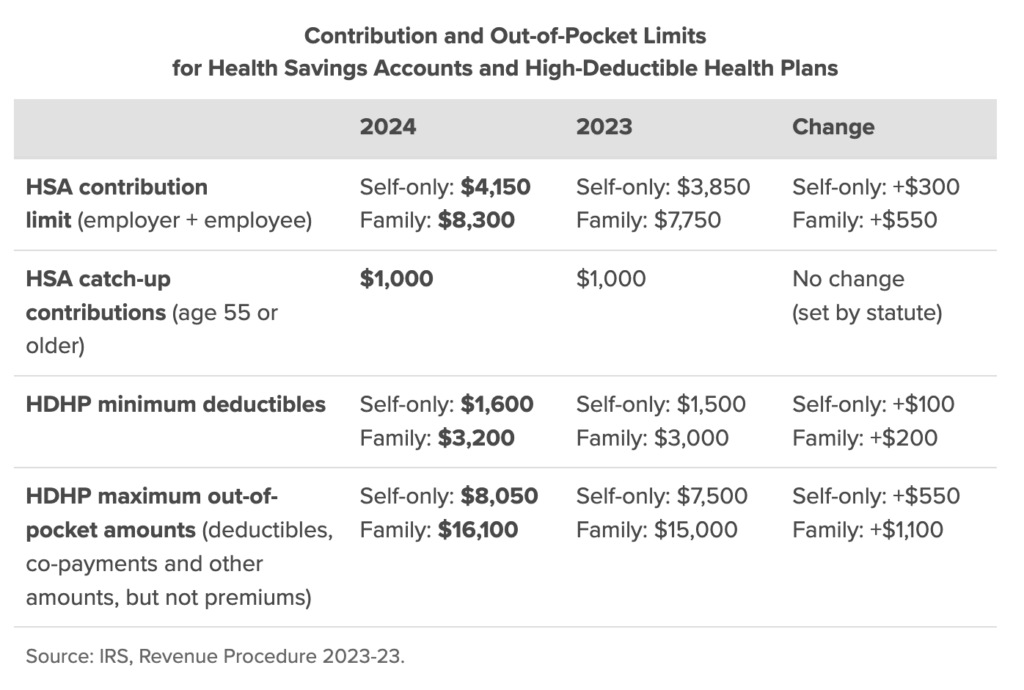

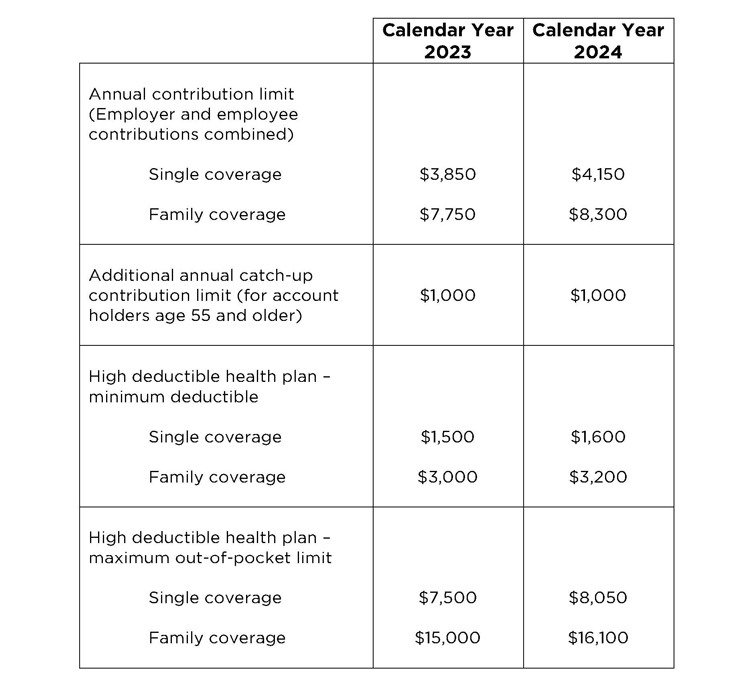

Significant HSA Contribution Limit Increase for 2025, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025. As health plan sponsors navigate the open enrollment season, it’s.

What Is Hsa Contribution Limit For 2025 Helge Fernande, There are no changes to dependent. The 2025 maximum health fsa contribution limit is $3,200.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). It's not a huge jump,.

See Record Increase in Health Savings Account 2025 Cap. Why should you, The 2025 health flexible spending account (health fsa) contribution limit for eligible health expenses is $3,200. The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas.

Health Care FSAFEDS Contribution Limits Increase for 2025, It's not a huge jump,. The 2025 hsa contribution limit for families is $8,300, a 7.1% increase from the 2025 limit of $7,750.

The IRS Just Announced the 2025 Health FSA Contribution Cap!, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. This is a $150 increase from the 2025 limit of $3,050.

2025 HSA and FSA Contribution Limits Maximize Your Healthcare Savings, For unused amounts in 2025, the maximum amount that can be carried over to 2025 is $610. It's not a huge jump,.

2025 Health FSA Limit Increased to 3,200, As health plan sponsors navigate the open enrollment season, it’s. For 2025, you can contribute up to $4,150 if you have individual coverage, up.

The irs announced today that the health flexible spending account (fsa) cap for 2025 is $3,200, a $150 increase from 2025.