California W9 Form 2025. To use the application, you must have a u.s. What is the period of time.

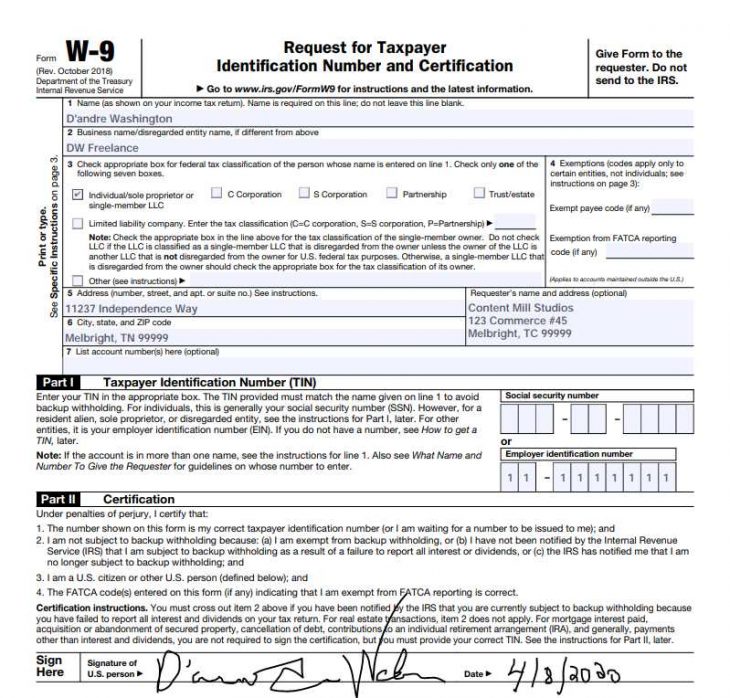

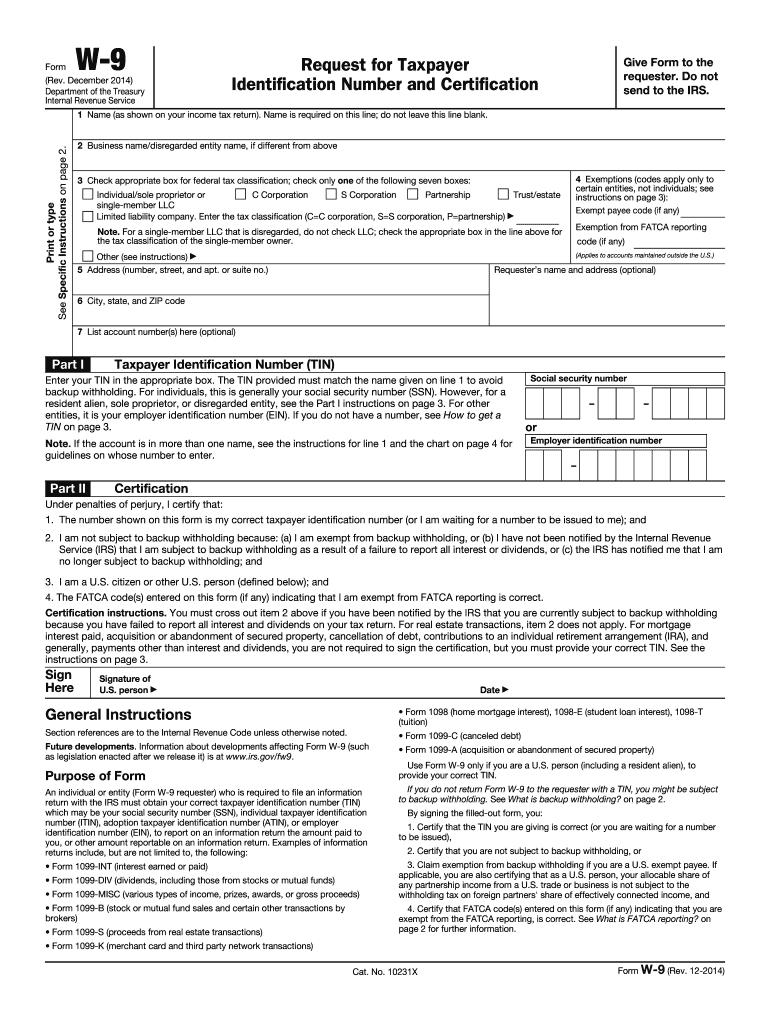

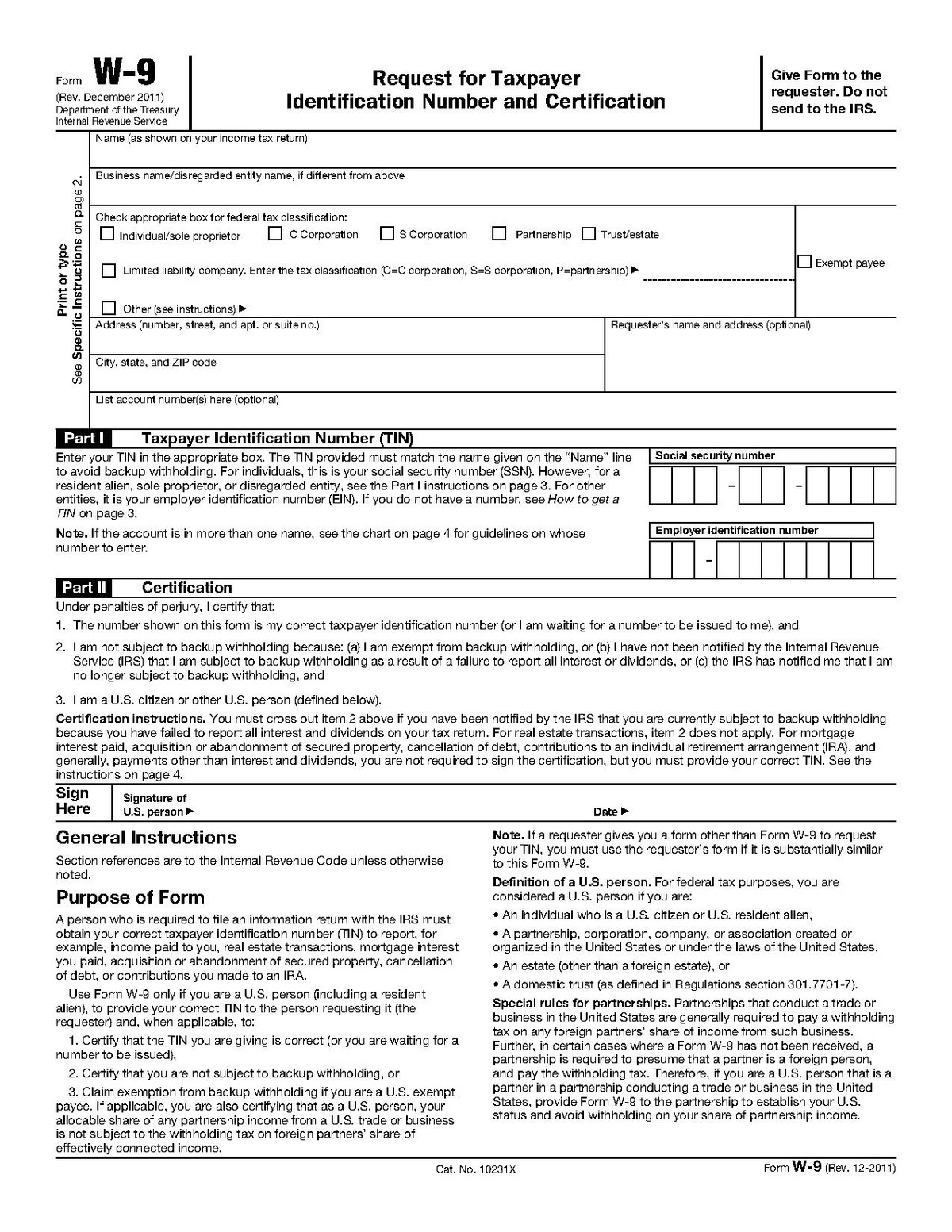

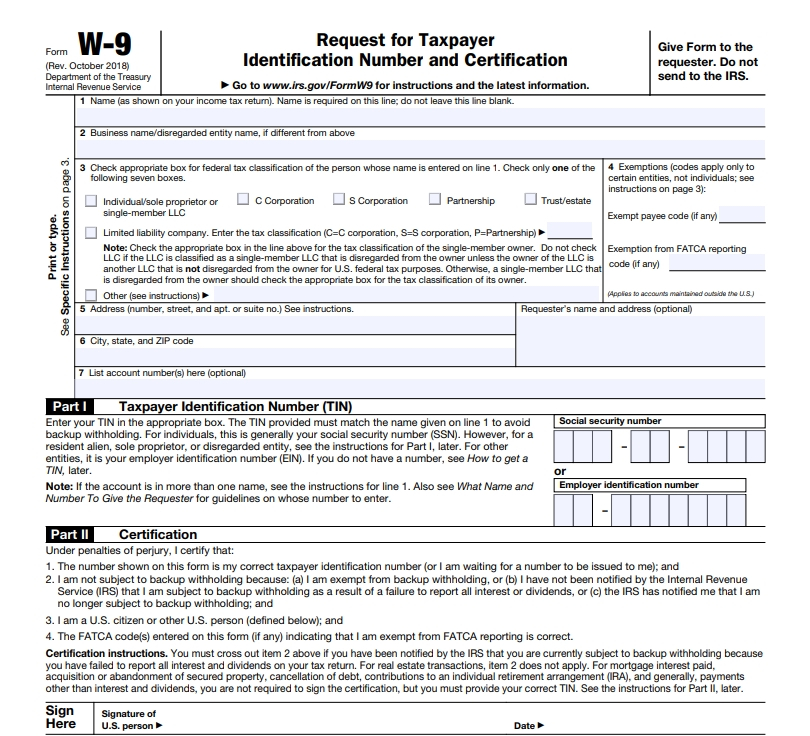

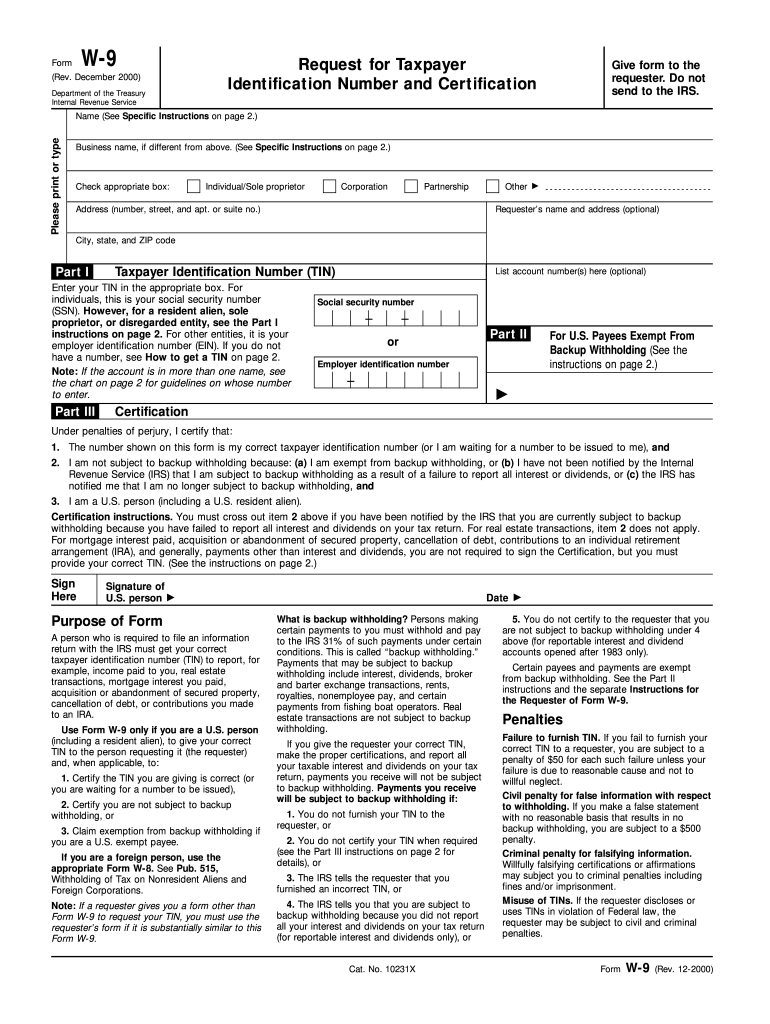

The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income. March 2025 march 15, 2025 share q.

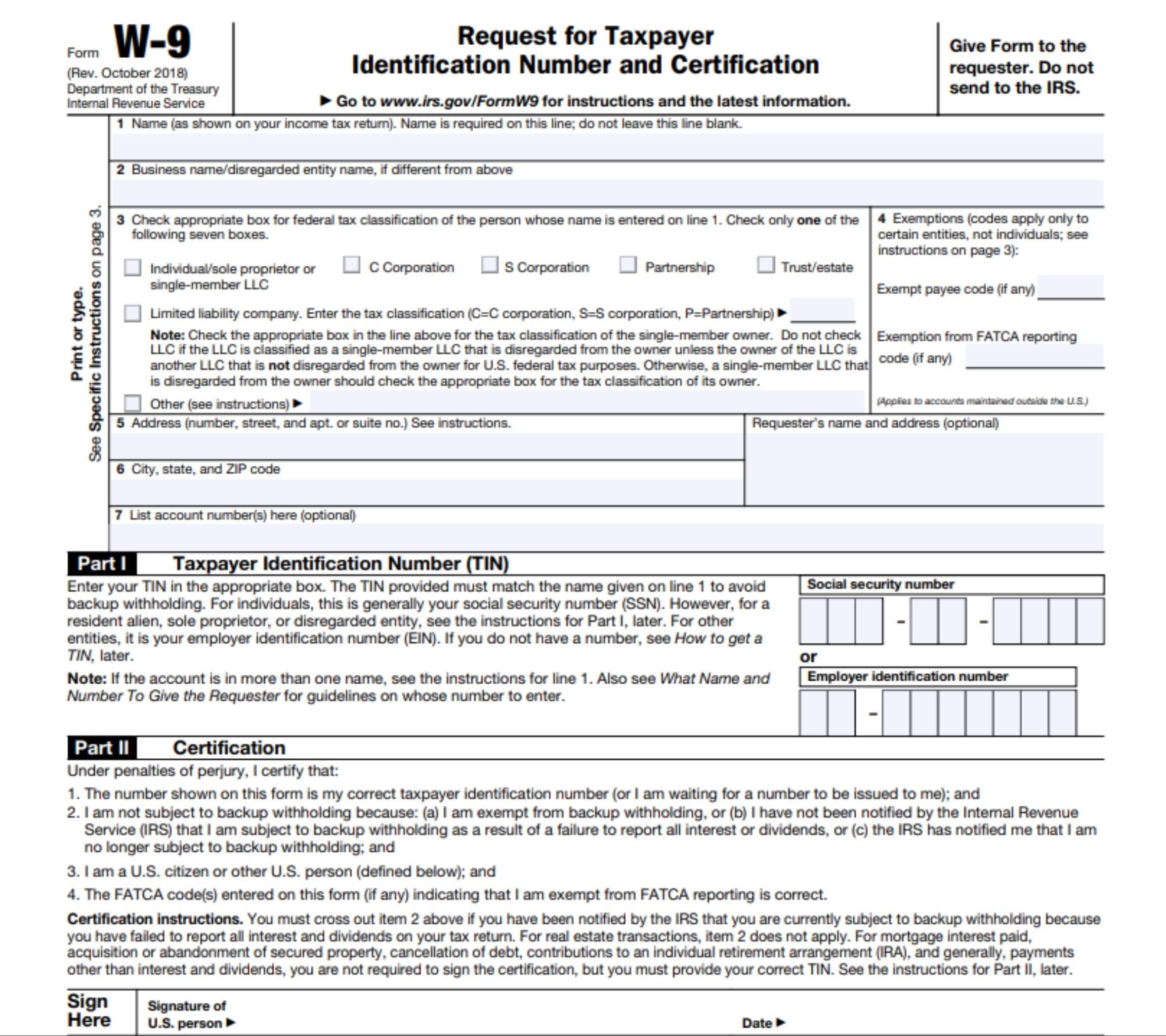

California W 9 Form Printable Printable W9 Form 2025 (Updated Version), All compensation from your employer is considered income,. By understanding these changes, taxpayers and businesses can ensure.

W9 Form 2025 California W9 Form 2025, The 2025 version replaces the version. This includes their name, address, employer identification number, and other.

What Is a W9 Form & How to Fill It Out, March 2025 march 15, 2025 share q. This form collects information from a person, such.

Printable Blank W9 Form Calendar Template Printable, Embracing m&a, ai, talent, and climate change mitigation. By understanding these changes, taxpayers and businesses can ensure.

W9 Form Printable 2017 Free Free Printable, Microsoft 365 formerly office 365, is a line of subscription services offered by. In order to do this, the content must be substantially similar to the.

Printable W 9 Form 2025 Printable Cards, For tax year 2025, this tax filing application operates until october 15, 2025. Phone number that accepts text.

Irs Free Printable W9 Form Printable Forms Free Online, The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income. Microsoft 365 formerly office 365, is a line of subscription services offered by.

¿Quién debe completar el formulario W9 del IRS?, Embracing m&a, ai, talent, and climate change mitigation. This form collects information from a person, such.

State W9 Forms W9 Form Printable, Fillable 2025 regarding Printable, Phone number that accepts text. The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income.

2025 IRS Printable W9 Form Printable W9 Form 2025 (Updated Version), The 2025 version replaces the version. The form acts as an agreement that you, as a contractor or freelancer, are responsible for withholding taxes from your income.