401k Contribution Limits 2025 Catch Up. Max 401k contribution with catch up 2025 alia louise, that limit also applies to 457, 403. The limit on total employer and employee contributions for 2025.

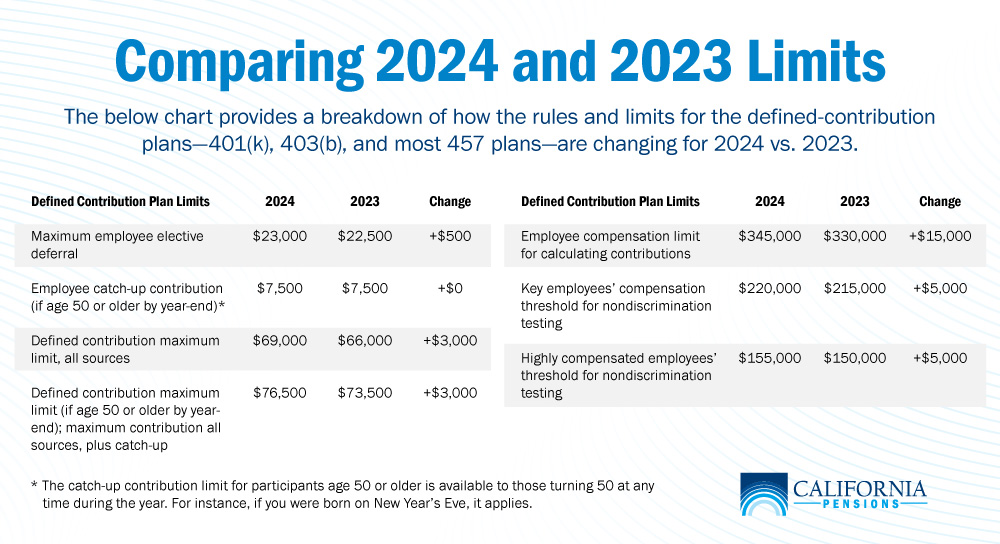

For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025. There are annual limits to how much you can contribute to your 401 (k).

Irs Limits On 401k Contributions 2025 Meg Margeaux, The 401 (k) contribution limits in 2025 have increased for employees to $23,000. Max 401k contribution with catch up 2025 alia louise, that limit also applies to 457, 403.

Max 401k Contribution With Catch Up 2025 Alia Louise, That limit also applies to 457, 403 (b) and the federal. Only people who earned $145,000 or more in wages in the prior year at their company will be able to fully.

401k Limits 2025 Catch Up Age Celine Lavinie, The contribution limit for a designated roth 401 (k) increased $500 to $23,000 for 2025. 2025 401k catch up contribution limits 2025 over 50.

Lifting the Limits 401k Contribution Limits 2025, Limits for those under age 50 went up by $3,000 for traditional and roth 401 (k)s and $1,500 for simple 401 (k)s. The 401 (k) contribution limits in 2025 have increased for employees to $23,000.

Contribution Limits Increase for Tax Year 2025 For Traditional IRAs, For 2025, the limit for 401 (k) plan contributions is $23,000, up from $22,500 last year, according to the irs. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

2025 Contribution Limits Announced by the IRS, Only people who earned $145,000 or more in wages in the prior year at their company will be able to fully. In 2025, the limit on employee elective deferrals for 401(k) plans is $23,000, with those age 50 and older able to make an additional $7,500 in.

What Is The 401k Catch Up Limit For 2025 Olly Rhianna, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal. The limit for overall contributions—including the employer match—is 100%.

What’s the Maximum 401k Contribution Limit in 2025? (2025), What you need to know. The 2025 limit was $22,500.

401(k) Contribution Limits in 2025 Meld Financial, The 401 (k) contribution limits in 2025 have increased for employees to $23,000. For 2025, the employee contribution limit for.

401k 2025 Contribution Limit IRA 2025 Contribution Limit, The 2025 limit was $22,500. The limit for overall contributions—including the employer match—is 100%.